Be wary of mixing pleasure with business

This page may contain links to Amazon.com or other sites from which I may receive commission on purchases you make after clicking on such links. Read my full Disclosure Policy

Most of my clients use PayPal or email transfer to pay their invoices, but some prefer to pay by check. Sometimes I receive one from a client’s personal account, or even a joint account with their spouse. Today Kimberley Laws will explain why this isn’t a good practice and how to keep your business and personal finances separate.

Life as a sole entrepreneur can be strange, particularly if you work from home. The line between your work and home life can grow fuzzy. And, as a result, your accounting can get a little–um, how does one put this nicely–“intermingled” too. If your business and personal finances have morphed together into one giant and complicated mess–no more mincing words–do not dismay. With a little work and a healthy dose of stick-to-itiveness, you can correct the confusion and usher in a new and user-friendly system.

The Combined Finances Conundrum

If your personal and business finances are merged, you could have some major problems in the foreseeable future.

- Everything is at risk. According to “Keeping Business and Personal Finances Separate,” a failure to have a clear distinction between your business and personal expenses leads to what is known as “Piercing the Corporate Veil,” and, subsequently, your personal assets could be seized to satisfy your company’s creditors. Yes, everything you have worked so hard for could be taken to pay business liabilities.

- Your accounting expenses are higher. If your accounts are in good order–which includes keeping your business and personal monies separate–you can save a fortune on bookkeeping and accounting costs. If your accountant charges by the hour–and odds are that they do–the last thing you want is for them to spend oodles of time trying to sort out what expenses are personal and which are commercial. Plus, your confusing finances could also lead to you missing out on potential deductions.

- You could raise a red flag for the taxman. If you don’t operate like a full-fledged business, the IRS may have trouble believing that your business actually exists. You need to be able to document your expenses–a nearly impossible feat when your personal and company paperwork are all mixed up. And, if you’ve been charging family meals, household expenses, and other personal items on your business credit cards, you’ve opened up a messy proverbial can of worms.

- You haven’t built up business credit. If you’ve been using your personal accounts to operate your business, you have failed to establish a credit history for your company. According to “Are Your Personal and Business Finances Tangled Up?,” lenders, vendors, and landlords–and other stakeholders who may require your financial statements–will be left unimpressed by your sloppy bookkeeping. And, if they can’t determine if your business is profitable, how can you?

Separating Finances & Starting Fresh

By following a few easy steps, you can fix your fiscal fiasco and start fresh.

- Open separate bank accounts. The first step is to open a business account, order some business cheques, and draw a solid line in the sand between your personal name and business entity.

- Get a company credit card. No more charging company expenses to your personal Visa card. This will enable you to keep your expenses separate much more easily.

- Get a new filing cabinet. Whether you use a full-fledged metal cabinet, a cardboard folio, or a shoebox, you will need to have a separate place to store your business receipts.

- Recruit help. This is a great time to seek the help of a consummate professional. Plus, if math is really not your thing, “How to Manage Finances if You’re Not Good at Math” offers that there are simple software programs to help you manage your finances–even if you’re a number-crunching novice.

- Become official. Entrepreneur‘s “Keep Your Business and Personal Finances Separate” also recommends establishing a limited liability company or S Corporation in order to protect your personal assets.

Diminish those tax time worries, bid adieu to bookkeeping migraines, and most importantly, protect your personal assets. Keeping your business and personal life separate will not only prove financially beneficial, but it will help keep your working world from taking over. Grab a big stick and draw that thick line in the beach. But just don’t call the trip there a business expense.

What advice can you offer someone who is trying to separate their business and personal finances?

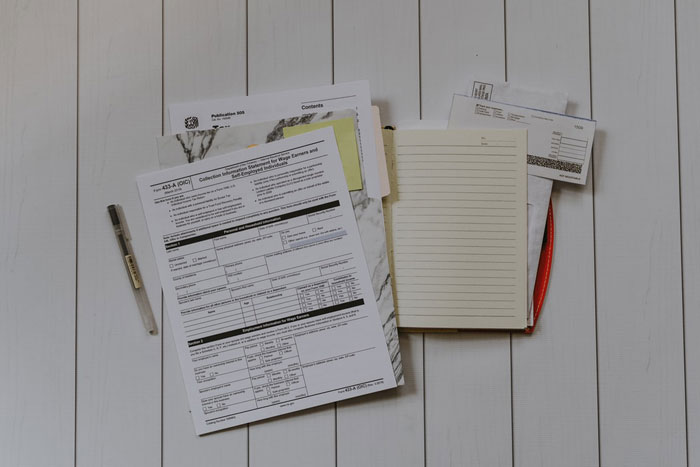

Image courtesy of ddpayumba at FreeDigitalPhotos.net

Fantastic advice! A lot of financial woes can be avoided by simply following a lot of these. It would be so good if a lot of people who are starting their own businesses could read this.

For sure! I’m glad that Kimberley included a few steps for people who weren’t aware of (or ignored) these practices in the beginning.

Great read! Thank you very much. Lots to think about here, especially with the personal & business finances.